当事務所は、以下の期間、年末・年始休業とさせて頂きます。

■休業期間 令和6年12月28日(土)から令和7年1月5日(日) なお、年始は1月6日(月)より通常業務を開始致します。

当事務所は、以下の期間、年末・年始休業とさせて頂きます。

■休業期間 令和6年12月28日(土)から令和7年1月5日(日) なお、年始は1月6日(月)より通常業務を開始致します。

当事務所は、以下の期間、年末・年始休業とさせて頂きます。

■休業期間 令和5年12月29日(金)から令和6年1月4日(木) なお、年始は1月5日(金)より通常業務を開始致します。

当事務所は、以下の期間、夏季休業とさせて頂きます。

■休業期間

令和5年8月11日(金)から令和5年8月15日(火)まで

休業期間中は何かとご迷惑をお掛けすることと存じますが、何卒よろしくお願い申し上げます。

当事務所は、以下の期間、年末・年始休業とさせて頂きます。

■休業期間 令和4年12月29日(木)から令和5年1月4日(水) なお、年始は1月5日(木)より通常業務を開始致します。

当事務所は、以下の期間、夏季休業とさせて頂きます。

■休業期間

令和3年8月10日(火)から令和3年8月13日(金)まで

休業期間中は何かとご迷惑をお掛けすることと存じますが、何卒よろしくお願い申し上げます。

Virtual shareholder meetings are becoming common world wide

According to a report by proxy advisory firm Institutional Shareholder Services Inc. (“ISS”), 56% of shareholder meetings in the U.S. and 12% in Europe were held on a virtual-only format in 2020 (https://www.issgovernance.com/file/publications/top-governance-stewardship-issues-2021.pdf).

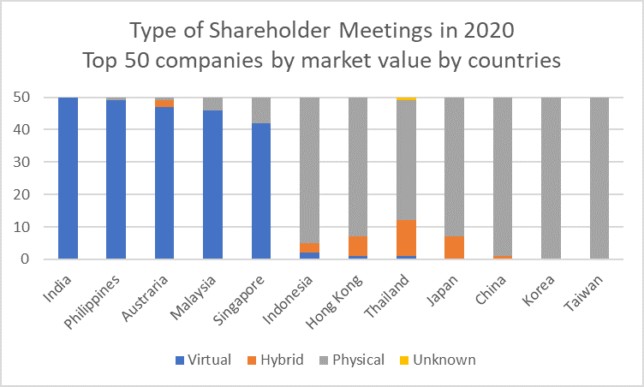

Virtual-only format has also become common in some Asian countries. According to a corporate governance report released by the Asian Corporate Governance Association (ACGA) in May 2021, the majority of the top 50 companies by market capitalization in countries such as India, the Philippines, Australia, Malaysia and Singapore held virtual-only shareholder meetings in 2020 while no companies in Japan, China, Korea and Taiwan have adopted virtual-only format.

Legal hurdles removed in Japan

In Japan, the current Companies Act does not allow companies to hold virtual-only shareholder meetings. Keidanren, Japan Business Federation, lobbied the government to relax the rule to address the COVID-19 crisis and reduce operating costs. In response, the government passed the Industrial Competitiveness Enhancement Act and enacted on June 16, 2021 to allow virtual-only shareholder meetings (https://www.meti.go.jp/policy/economy/keiei_innovation/keizaihousei/virtual-only-shareholders-meeting_explanatory-material-en.pdf). The new law requires companies to amend their articles of incorporation to allow virtual-only shareholder meetings after obtaining confirmation from the Minister of Economy, Trade and Industry and the Minister of Justice. Over the next two years, however, companies will be able to hold virtual-only shareholder meeting without modifying the articles of incorporation, provided they obtain the necessary confirmations.

Last June, at least 10 companies, such as Sumitomo Mitsui Financial Group (“SMFG”), Softbank Group, Takeda Pharmaceutical and Z Holdings (Yahoo! Japan), amended their articles of incorporations at the shareholders’ meetings according to Mitsubishi UFJ Trust.

Some investors have expressed concern about virtual-only shareholder meetings

When companies proposed to amend the articles of incorporations to introduce virtual only-shareholder meetings, ISS recommended to vote against those proposals as (1) virtual-only format could hinder meaningful exchange between the company and its shareholders, and (2) there is no consensus among companies and shareholders on best practices for virtual-only shareholder meetings. ISS recommended hybrid shareholder meetings where investors can attend physically if they wish.

Takeda Pharmaceutical proposed the amendment limiting the virtual-only shareholder meetings to “situations such as the spread of an infectious disease or the occurrences of a natural disaster.” SMFG and Softbank Group were forced to announce that they had no immediate plans to hold virtual-only shareholder meetings under non-emergency conditions.

(https://www.smfg.co.jp/english/investor/financial/meeting/2021_pdf/e_hosoku02_202106.pdf, https://group.softbank/en/news/info/20210604)

Virtual-only shareholder meetings are coming to Japan nonetheless

Last June, Asteria, a Japanese blockchain software developer, held a shareholder meeting and asked shareholders not to attend the physical meeting but participate via the internet and vote real time using the company’s blockchain technology if the shareholders had not exercised their right beforehand. No shareholders physically showed up, hence it became the first Japanese listed company to hold a virtual-only shareholder meeting. Shareholder questions were submitted via the internet and recited by a company investor relations officer and answered by the CEO. Asteria will continue to hold virtual shareholder meetings.

Z Holding, which amended its articles of incorporation this year, stated in a Q&A note that it will hold a virtual-only shareholders meeting next year (https://www.z-holdings.co.jp/en/ir/stock/agm/main/00/teaserItems1/00/linkList/03/link/en2021QA.pdf).

These companies are technology companies and it is natural that they would want to try the virtual-only format. However, most Japanese companies consider shareholders meetings to be important but also expensive and stressful. It is natural for Japanese companies to consider going virtual once investors begin to accept the virtual-only format.

Hajime Nakata, Jiro Masuda (Nakata & Partners Law Office)

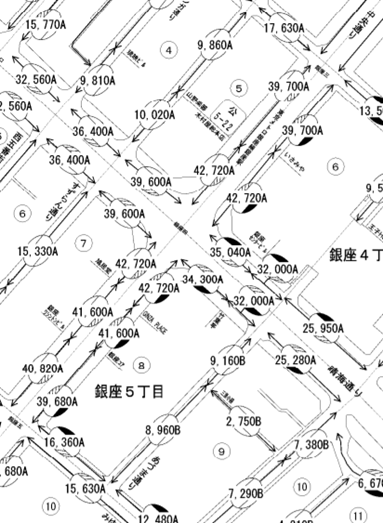

Japan’s tax agency has released the roadside land prices (“Rosenka”) on July 1, 2021. The average roadside land prices fell for the first time since 2015. The decline of the roadside land price was already expected when the land ministry revealed the result of the land price survey (“Koji Kakaku”), about 26,000 locations nationwide, on March 23 this year. The roadside land prices are shown on maps, as an example below, with prices shown in thousands of yen per square meter. The most expensive roadside land price, 42.7 million yen per square meter, down 7.0% from previous year, was located on Ginza Chuo-dori near the intersection with Harumi-dori where stores such as Mitsukoshi and Mikimoto are placed.

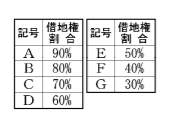

The alphabet attached to the roadside land price indicates the ratio of the leasehold value to the total value of the land. If an “A” is attached to the roadside land price, the value of the leasehold is 90% of the land value. For the meanings of the other letters of the alphabet, please see the table below.

Maps of roadside land prices can be found at the following link: https://www.rosenka.nta.go.jp/main_r03/index.htm

The roadside land price is used to calculate the inheritance tax and does not necessarily represent the market value of the land. First, the roadside land price is set at about 80% of the “fair values” of lands surveyed by the land ministry at the beginning of each year. Second, the market value may deviate from the fair value. Third, the roadside land prices do not reflect the land-specific price factors like shape, direction, etc. In addition, when calculating the value of leasehold, various contractual clauses must be taken into account. The ratio shown on the roadside land price map may be differ significantly from the actual ratio.

Despite some caveats, like above, roadside land prices are useful in assessing land values.

Hajime Nakata, Jiro Masuda (Nakata & Partners Law Office)

本年1月5日をもって松本成(まつもと なる)弁護士が当事務所に参加致しました。

松本弁護士は、シカゴ大学法科大学院修士課程を修了し、米国ニューヨーク州弁護士資格も有する国際弁護士であり、これまで海外競争法案件や国際取引案件等、多岐に亘る実務に携わってきた経験豊富な弁護士です。海外、国際案件はもちろん、企業法務一般についても皆さまのお役に立てるかと存じますので、ぜひご期待下さい。

当事務所は、以下の期間、年末・年始休業とさせて頂きます。

■休業期間

令和2年12月29日(火)から令和3年1月4日(月)

なお、年始は1月5日(火)より通常業務を開始致します。

本年12月17日より、益田治郎(ますだ じろう)弁護士が当事務所に参加致しました。

益田弁護士は、ゴールドマン・サックス証券会社における20年以上の勤務期間において、事業法人の資金調達、企業オーナーの資産運用等の業務を担当してきたという異色の経歴を有する弁護士です。益田弁護士の企業金融に関する知見を活かし、相続や事業承継、資産分散防止策を含むポートフォリオ構成までを意識した戦略的法務を提供できるものと期待致しております。