Virtual shareholder meetings are becoming common world wide

According to a report by proxy advisory firm Institutional Shareholder Services Inc. (“ISS”), 56% of shareholder meetings in the U.S. and 12% in Europe were held on a virtual-only format in 2020 (https://www.issgovernance.com/file/publications/top-governance-stewardship-issues-2021.pdf).

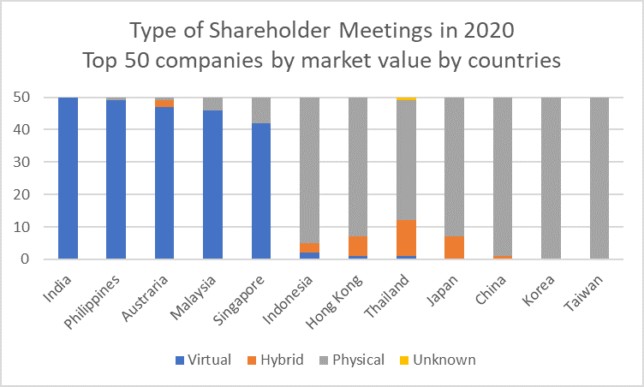

Virtual-only format has also become common in some Asian countries. According to a corporate governance report released by the Asian Corporate Governance Association (ACGA) in May 2021, the majority of the top 50 companies by market capitalization in countries such as India, the Philippines, Australia, Malaysia and Singapore held virtual-only shareholder meetings in 2020 while no companies in Japan, China, Korea and Taiwan have adopted virtual-only format.

https://www.acga-asia.org/cgwatch.php

Legal hurdles removed in Japan

In Japan, the current Companies Act does not allow companies to hold virtual-only shareholder meetings. Keidanren, Japan Business Federation, lobbied the government to relax the rule to address the COVID-19 crisis and reduce operating costs. In response, the government passed the Industrial Competitiveness Enhancement Act and enacted on June 16, 2021 to allow virtual-only shareholder meetings (https://www.meti.go.jp/policy/economy/keiei_innovation/keizaihousei/virtual-only-shareholders-meeting_explanatory-material-en.pdf). The new law requires companies to amend their articles of incorporation to allow virtual-only shareholder meetings after obtaining confirmation from the Minister of Economy, Trade and Industry and the Minister of Justice. Over the next two years, however, companies will be able to hold virtual-only shareholder meeting without modifying the articles of incorporation, provided they obtain the necessary confirmations.

Last June, at least 10 companies, such as Sumitomo Mitsui Financial Group (“SMFG”), Softbank Group, Takeda Pharmaceutical and Z Holdings (Yahoo! Japan), amended their articles of incorporations at the shareholders’ meetings according to Mitsubishi UFJ Trust.

Some investors have expressed concern about virtual-only shareholder meetings

When companies proposed to amend the articles of incorporations to introduce virtual only-shareholder meetings, ISS recommended to vote against those proposals as (1) virtual-only format could hinder meaningful exchange between the company and its shareholders, and (2) there is no consensus among companies and shareholders on best practices for virtual-only shareholder meetings. ISS recommended hybrid shareholder meetings where investors can attend physically if they wish.

Takeda Pharmaceutical proposed the amendment limiting the virtual-only shareholder meetings to “situations such as the spread of an infectious disease or the occurrences of a natural disaster.” SMFG and Softbank Group were forced to announce that they had no immediate plans to hold virtual-only shareholder meetings under non-emergency conditions.

(https://www.smfg.co.jp/english/investor/financial/meeting/2021_pdf/e_hosoku02_202106.pdf, https://group.softbank/en/news/info/20210604)

Virtual-only shareholder meetings are coming to Japan nonetheless

Last June, Asteria, a Japanese blockchain software developer, held a shareholder meeting and asked shareholders not to attend the physical meeting but participate via the internet and vote real time using the company’s blockchain technology if the shareholders had not exercised their right beforehand. No shareholders physically showed up, hence it became the first Japanese listed company to hold a virtual-only shareholder meeting. Shareholder questions were submitted via the internet and recited by a company investor relations officer and answered by the CEO. Asteria will continue to hold virtual shareholder meetings.

Z Holding, which amended its articles of incorporation this year, stated in a Q&A note that it will hold a virtual-only shareholders meeting next year (https://www.z-holdings.co.jp/en/ir/stock/agm/main/00/teaserItems1/00/linkList/03/link/en2021QA.pdf).

These companies are technology companies and it is natural that they would want to try the virtual-only format. However, most Japanese companies consider shareholders meetings to be important but also expensive and stressful. It is natural for Japanese companies to consider going virtual once investors begin to accept the virtual-only format.

Hajime Nakata, Jiro Masuda (Nakata & Partners Law Office)